HMRC warning as interest rates on late payment to rise today | Personal Finance | Finance | Express.co.uk

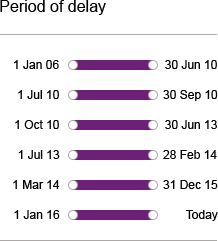

The rate of late tax payments interest rates continues to rise | Accountants Bury St Edmunds & Thetford - Knights Lowe

Worried about your January 2021 tax bill? HMRC's service to spread the payment may help | Low Incomes Tax Reform Group

HMRC self-assessment warning that millions have three days to avoid tax deadline fine - Wales Online