Solvency capital requirement and the claims development result | British Actuarial Journal | Cambridge Core

Measuring market and credit risk under Solvency II: evaluation of the standard technique versus internal models for stock and bond markets | SpringerLink

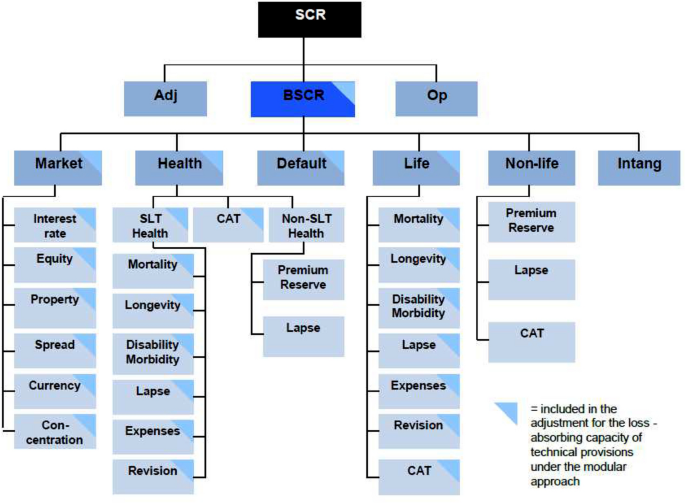

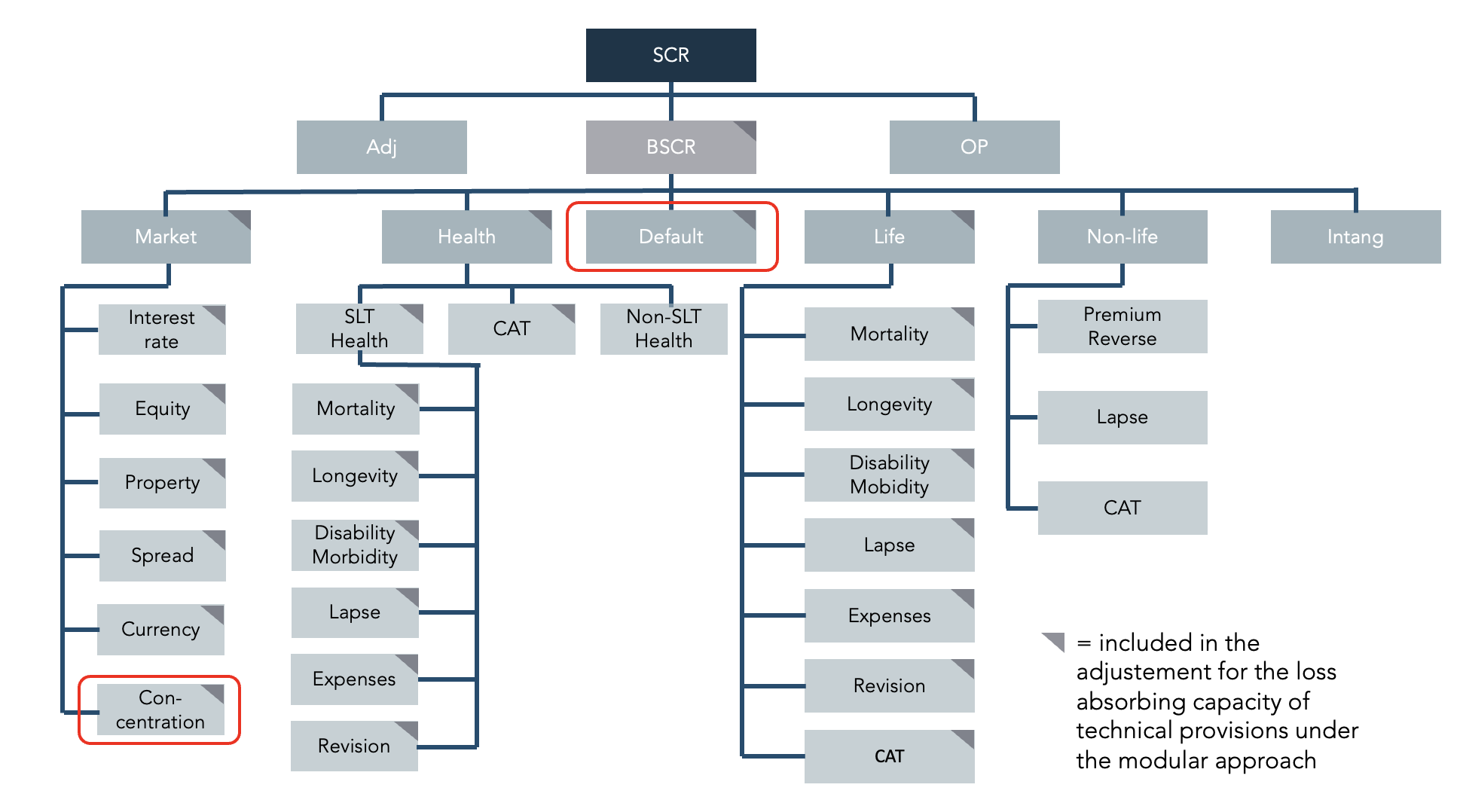

Solvency II Standard Formula Structure Source: European Insurance and... | Download Scientific Diagram

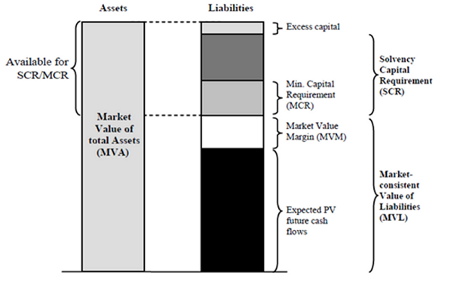

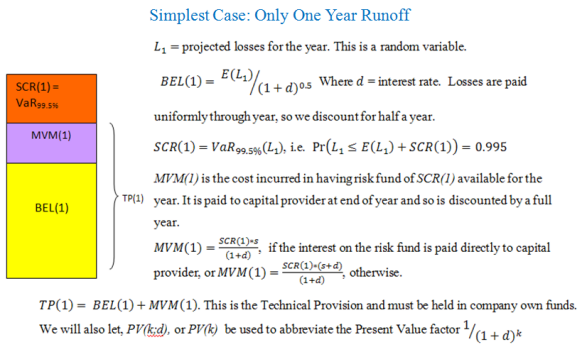

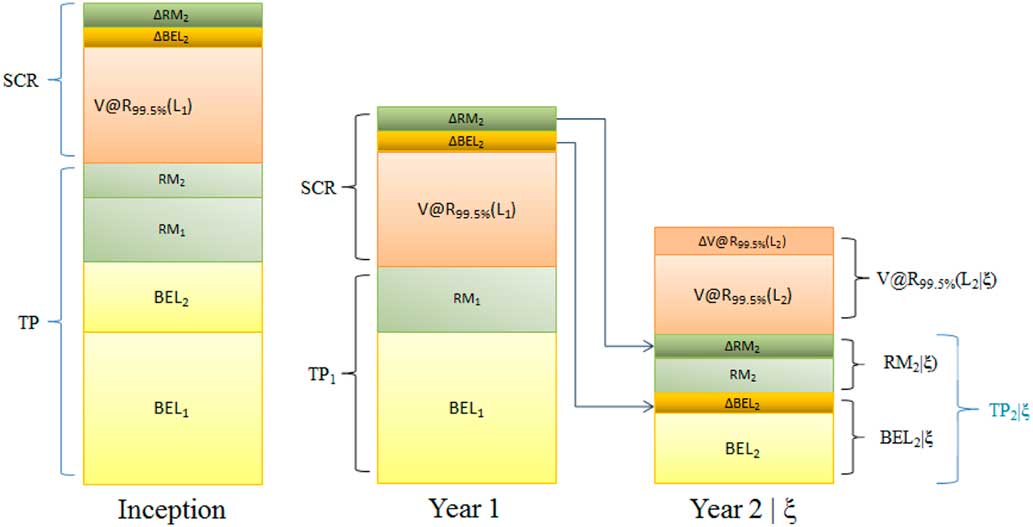

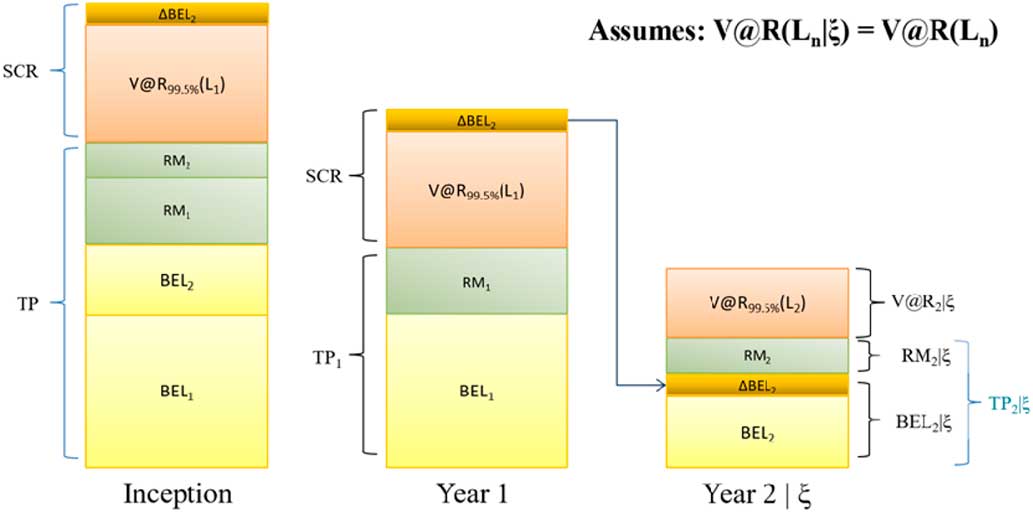

Solvency capital requirement and the claims development result | British Actuarial Journal | Cambridge Core